The phrase “financial equipment” often comes up in discussions about banking, investment, or technology-driven finance. The concept of financial instruments is actually quite straightforward, despite the fact that it may seem complicated. Any tools, instruments or mechanisms that help people or organizations manage, track or grow their money are essentially considered financial instruments. Financial tools are essential to managing our financial lives, from traditional tools to smartphone banking apps like state-of-the-art innovations like checkbooks.

Describe the components of financial instruments

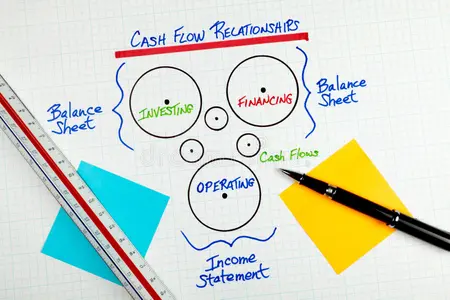

Any resource that facilitates financial operations, such as borrowing, spending, investing or saving, can be considered a financial instrument. These devices include not only tangible gadgets but also financial instruments and digital applications.

Type of financial instruments

Physical financial instruments: Checkbooks, credit cards, and debit cards are classic examples. These are physical instruments that facilitate payment processing and direct access to money.

Financial instruments include things like stocks, bonds and insurance policies in addition to tangible and digital gadgets. They serve as a means through which people and organizations can fulfill financial objectives such as retirement plans, wealth development and security.

Importance of financial equipment

Finance teams have changed the way they manage their finances:

Installation: People can make online purchases, send money and pay bills without having to go to the bank to search for digital devices.

Secure transactions are guaranteed by devices such as appropriate biometric applications or security encrypted credit cards.

Exercise: ATM and smartphone apps allow you to access money anytime, anywhere.

Decision support: Users can make a good decision with investment, insights and analytics platforms.

The future of financial teams

The future of financial teams is increasingly exciting due to financial technology or innovation in Fintech. Artificial intelligence is being used to enable and enable blockchain-based digital transactions such as smart watches, everyday purchases. -Financial equipment will become even more integrated into everyday life as the financial industry becomes more digital, providing a more spontaneous, faster and personal financial management experience.

conclusion

At its most basic, financial equipment (digital, physical, or end-to-end) is a device that facilitates better money management for both individuals and organizations. These devices are essential to contemporary financial life, from credit cards to mobile wallets, from stocks to System A apps.

People can improve their financial management, protect their future, and create financial devices and judiciously sophisticated financial scenarios using financial devices.