In today’s financial world, insurance is a common device that gives people a sense of protection against risks such as illness, accidents and natural disasters. However, the issue of insurance is more complicated in the context of Islam. Islamic teachings emphasize fairness and mutual aid, and discourage behavior associated with riba (interest), ghar (excessive uncertainty), and group (gambling). These ideas affected traditional insurance Muslim perceptions and gave rise to a different model that adheres to Sharia law.

Traditional insurance concerns

In conventional insurance, the policyholder is promised to reimburse the insurance company in return for paying a premium. Despite the straightforward appearance of this system, scholars suggest three primary problems that characterize Islamic principles:

There are interest-based financial products where many insurance companies invest their premium money. Islam refuses to charge or pay interest, which leads to important concerns.

Home (uncertainty): Traditional insurance has uncertainty. For example, if no claim is filed, the policyholder may continue to pay premiums for years without any profit. However, a large claim can be made as soon as the policy is brought. Islam forgoes ambiguity in financial contracts, which creates imbalance.

Mayasir (Gambling): According to some scholars, traditional insurance and gambling are comparable. Expecting to receive a large payment of a large amount is tantamount to an uncertain event of paying a small amount (premium).

Islamic optional: takaful

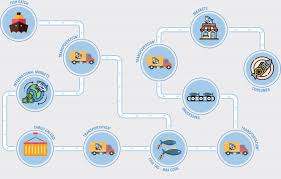

Islamic finance has established shared responsibilities and cooperative ideas to address these concerns. Takaful participants made financial contributions to a regular pool. Any member experiencing loss can get support from this group.

Unlike traditional insurance, unlike perseverance insurance, the emphasis is on mutual assistance, where companies take advantage of the premium. The participants collectively own this fund and usually nothing additional is returned to them or morally reconstructed.

Main features of takaful

Reciprocal contribution: Participants contribute to a shared fund in exchange for paying premiums for a business.

Shared risk: The group shares the risk as the loss is covered collectively.

Unexpected distribution: Money left after claims and expenses is often returned to participants instead of maintaining the company’s profit.

Insurance behavior of Muslims

Today, Takaful has developed a global industry offering non-conversion health, life, and Shariah insurance options. In many Muslim-majority countries, companies that work with traditional insurers offer an option that increases your confidence. When Takful is not available, Muslims living in non-Muslim countries can also opt for some traditional insurance, especially when laws require coverage, such as health or car insurance.

conclusion

Islam has not completely rejected the suggestion; Rather, it needs to coincide with the values of justice, openness and mutuality. Takaful offers a trust-based option that prefers cooperation and compassion, while traditional insurance often struggles with these principles.

Islam provides a model that not only molds individuals with dangers, but also strengthens the community relationship according to spiritual principles by converting insurance into a system of shared responsibility.